For example, import duties on certain products can make raw materials costly for the manufacturing sector and inflate overall COGS. Government regulations can also have a material effect on gross profit. For example, a company can choose to include car rentals as part of its Selling, General & Administrative (SG&A) expenses in COGS while another may exclude annual income means it. Accounting rules provide considerable leeway for management to include or exclude certain expenses from COGS. Gross profit is used to evaluate a company’s efficiency in converting raw materials into finished products. It is equal to a sum of the gross domestic product and foreign investments made by multinational companies operating in the country.

Other ways to use the yearly salary calculator

It’s larger than your net income, which is your income after taxes and other deductions have been withheld. Employers are required to withhold state and federal income taxes, Social Security taxes, and Medicare taxes. They also withhold benefits you’ve elected, like health insurance premiums and contributions to a flexible spending account or health savings account. If you earn $300 per week, your gross income for two weeks would be $600. It may be closer to $500 or $400, depending on factors like the state you live in and if you contribute any money to a retirement account.

- It is calculated as the overall profit from sale of goods minus production costs for those goods.

- Therefore, if you earn $648, you only pay FICA taxes, and have no other deductions, your net income will be $548.86 (or $648 multiplied by 1 minus the 15.3 percent tax rate).

- Knowing how to calculate your gross income is important for two reasons.

- The former refers to income earned from various sources without any applicable deductions while the latter is income earned from various sources minus deductions and taxes applicable.

- Therefore, COGS for ABC is a sum of all expenses incurred for production and is equal to $25,000.

- Calculating your yearly income can also help you see how your money is used for various expenses and how much may be left to meet financial goals, like buying a house or building an emergency fund.

How to Convert from Hourly to Yearly Salary?

The annual income calculator’s main aim is to help you find your yearly salary. However, it can calculate the rest of the variables – it depends on which values you input first. In analyzing a company’s earnings, GAI will often be disaggregated into Gross Margin, which is GAI as a percentage of total revenue earned. This figure is useful for comparing against other much smaller or larger companies.

How to calculate annual net income

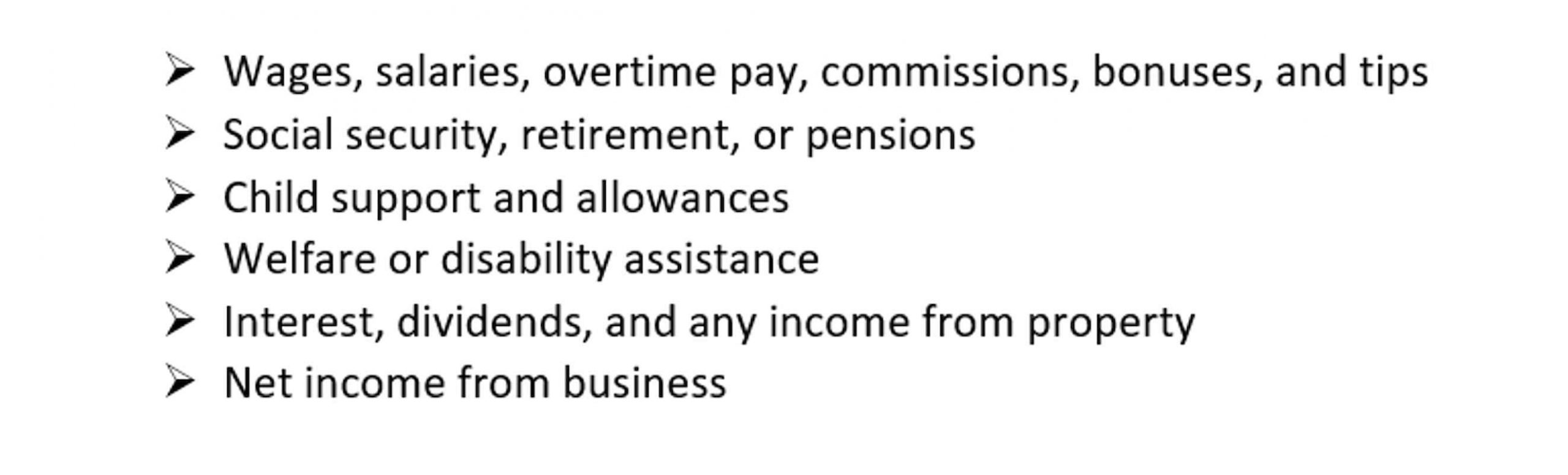

For business owners, self-employed and independent contractors/freelancers, payment is received as gross income and it is their responsibility to pay their share of taxes. A business’s gross income is calculated as gross revenue minus the cost of goods sold (COGS) and may be referred https://www.bookstime.com/ to as gross margin or gross profit margin as a percentage. Your gross income can be found on a pay stub as the total amount of money you earned in a given period before any deductions or taxes are removed. You can also see your total gross income on your year-end W2 or 1099.

Annual income vs. gross income vs. net income

To find your personal monthly gross income, calculate the amount of money you earn each month. This will likely be different than the amount of money you take home or receive as payment directly from your employer. The annual income calculator has become an indispensable tool for Tibor, aiding in transparent financial planning and salary assessments. It is equally beneficial for users ranging from freelancers to full-time employees who need to understand their compensation structure better. If you’re wondering how to calculate gross annual income by yourself – use the formula mentioned earlier; just remember to use your gross hourly wage.

What are Tax-Exempt Sources of Income?

The net effect will be that the first company will have a lower gross profit as compared to the second one. Net income is generally the last line in a company’s income statement. In addition to this, he earns $25,000 per year working as a teacher in a GMAT coaching firm. Each country has its own tax regime; however, there is a simple method to determine your percentage tax rate.

“Annual” means yearly, and “income” means profit, the money earned or received. Therefore, annual income means the amount of money obtained during a year. If you want to do it without the yearly salary income calculator, substitute your numbers into this formula.